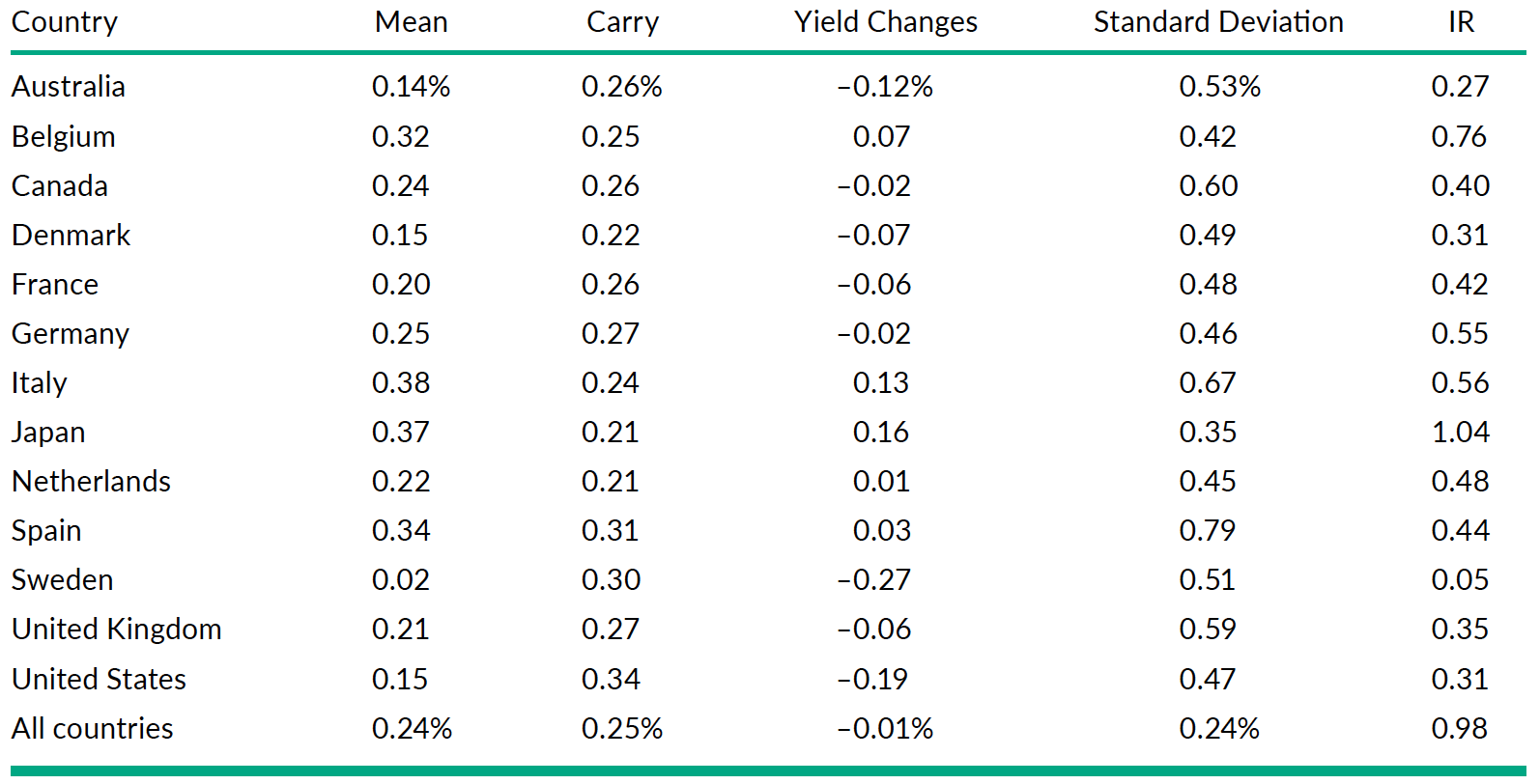

Carry and Roll-Down on a Yield Curve using R code

4.9 (755) · $ 14.00 · In stock

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Carry and Roll-Down on a Yield Curve using R code

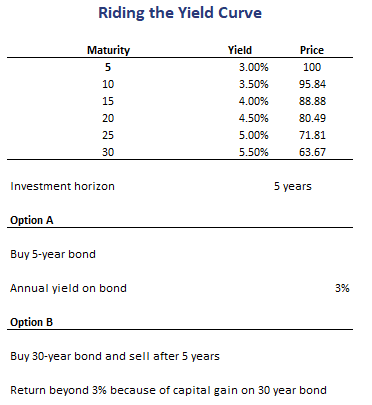

Riding the yield curve – BSIC Bocconi Students Investment Club

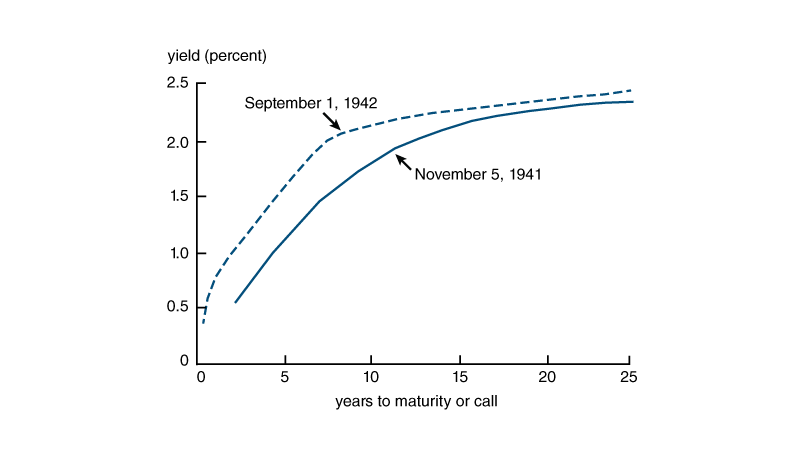

Yield Curve Control In The United States, 1942 to 1951 - Federal Reserve Bank of Chicago

Yield Curve - an overview

Riding the Yield Curve - Breaking Down Finance

Corporate bonds: Unraveling Roll Down Returns in Corporate Bond Portfolios - FasterCapital

:max_bytes(150000):strip_icc()/invertedyieldcurve-ecbda6a39c934e0fbf24332fb7592a30.jpg)

Inverted Yield Curve: Definition, What It Can Tell Investors, and Examples

Riding the Yield Curve and Rolling Down the Yield Curve Explained

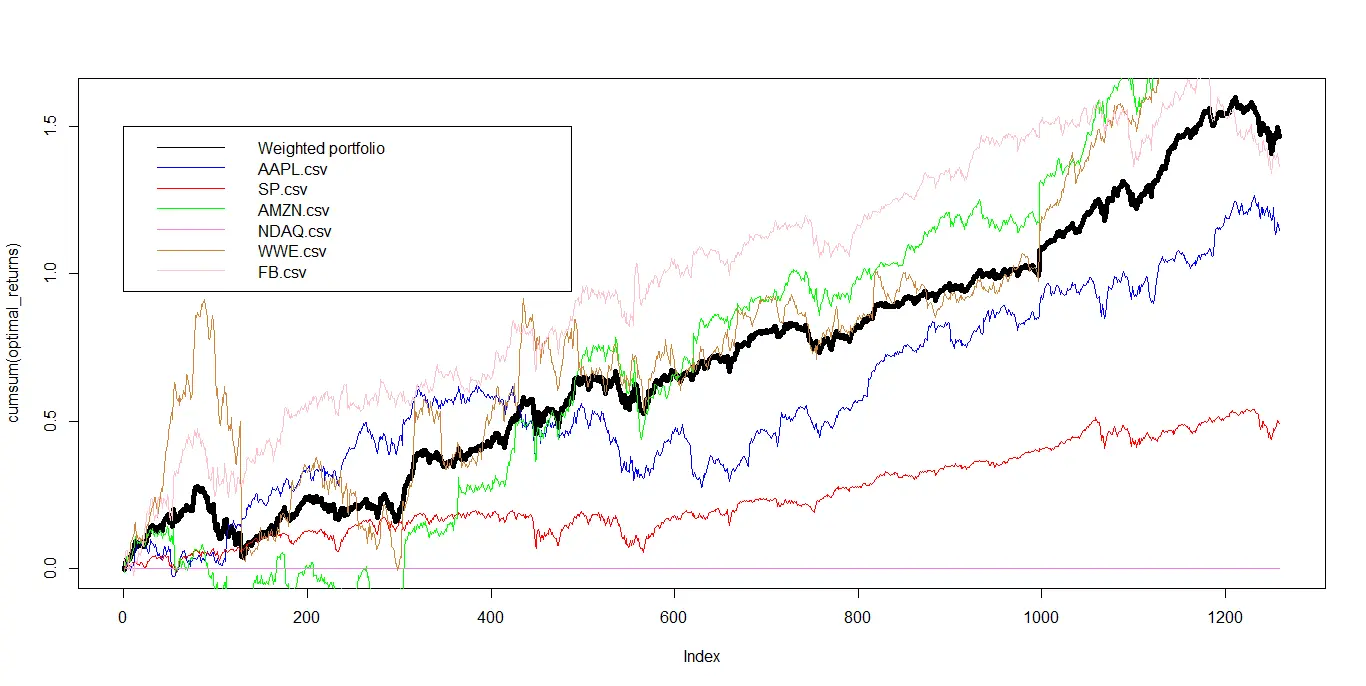

The Complete Guide to Portfolio Optimization in R PART1

:max_bytes(150000):strip_icc()/convexity-4198782-a4e62f51917a4d07a4d03fe386e87c95.jpg)

Convexity in Bonds: Definition, Meaning, and Examples