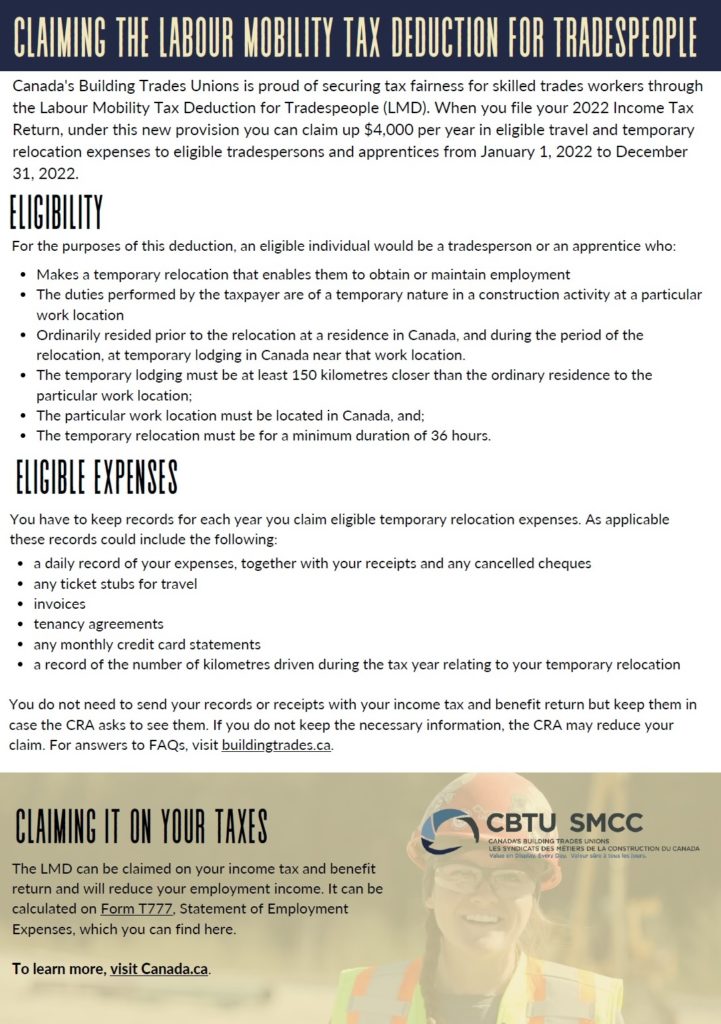

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

4.8 (551) · $ 15.50 · In stock

After over two decades of advocacy, tax fairness is now a reality for tradespeople across Canada.

Sustainable transport - Wikipedia

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

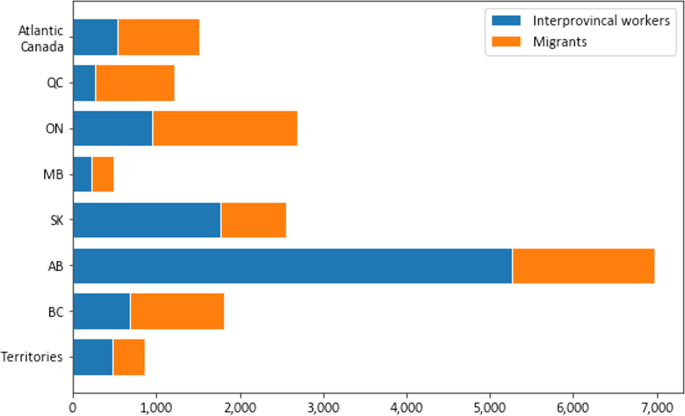

The Mobility of Construction Workers in Canada: Insights from

Crisis' in worker supply dominated 2022: national stakeholders

New housing, construction labour mobility highlighted by Freeland

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

Business Leaders Say Housing Biggest Risk To Economy: KPMG Survey

Federal budget earmarks $56-billion in new spending, higher taxes

Tax Updates for Employers and Employees in 2023

Moving our agenda forward… together! - SMART Union

Budget 2023 aligns clean infrastructure with labour and apprenticeship

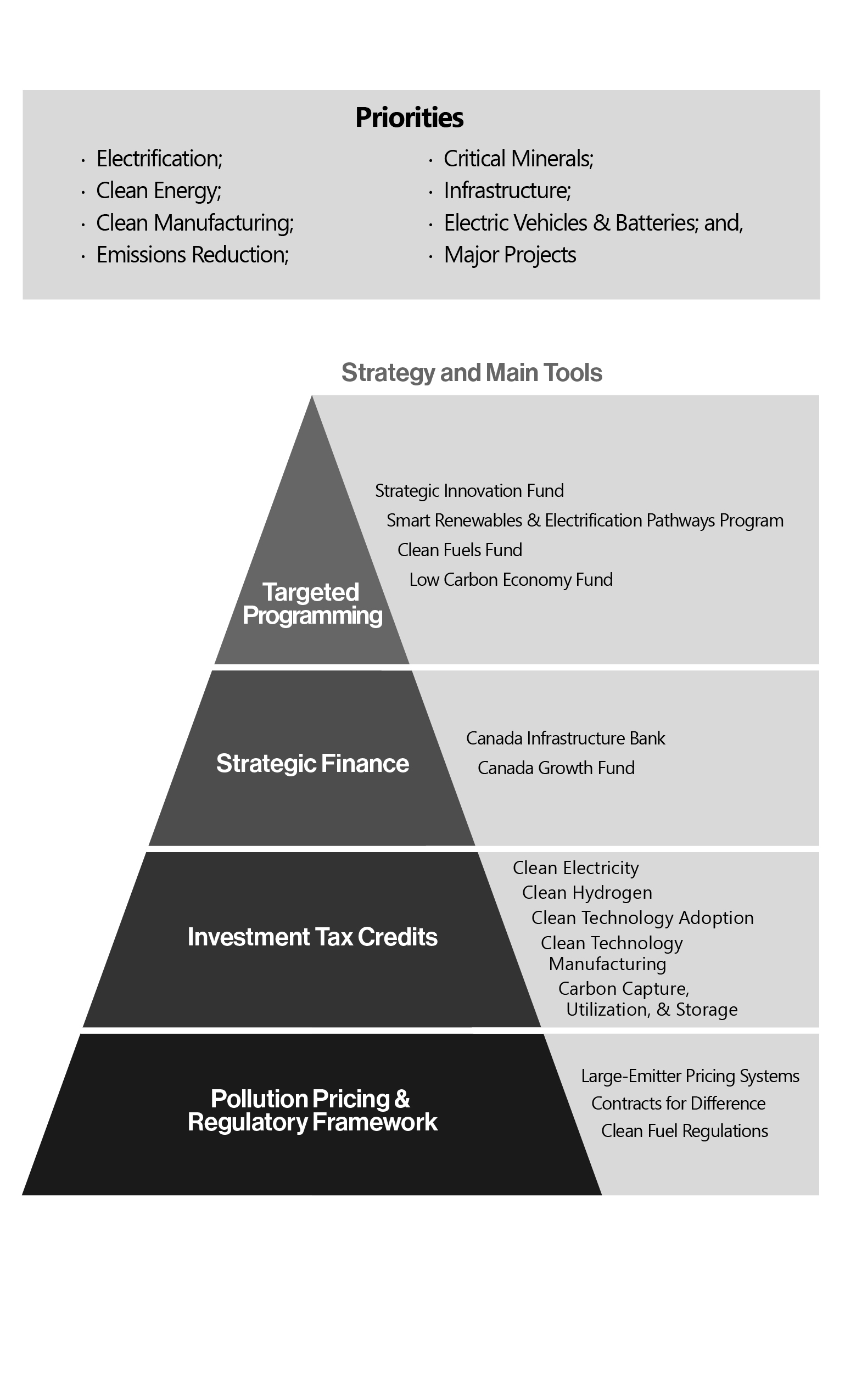

Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs

Knowledge Bureau - World Class Financial Education

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

CBTU hails mobility tax deduction for trades workers - Link2Build

:format(webp)/https://static-ph.zacdn.com/p/old-navy-7355-9297382-2.jpg)