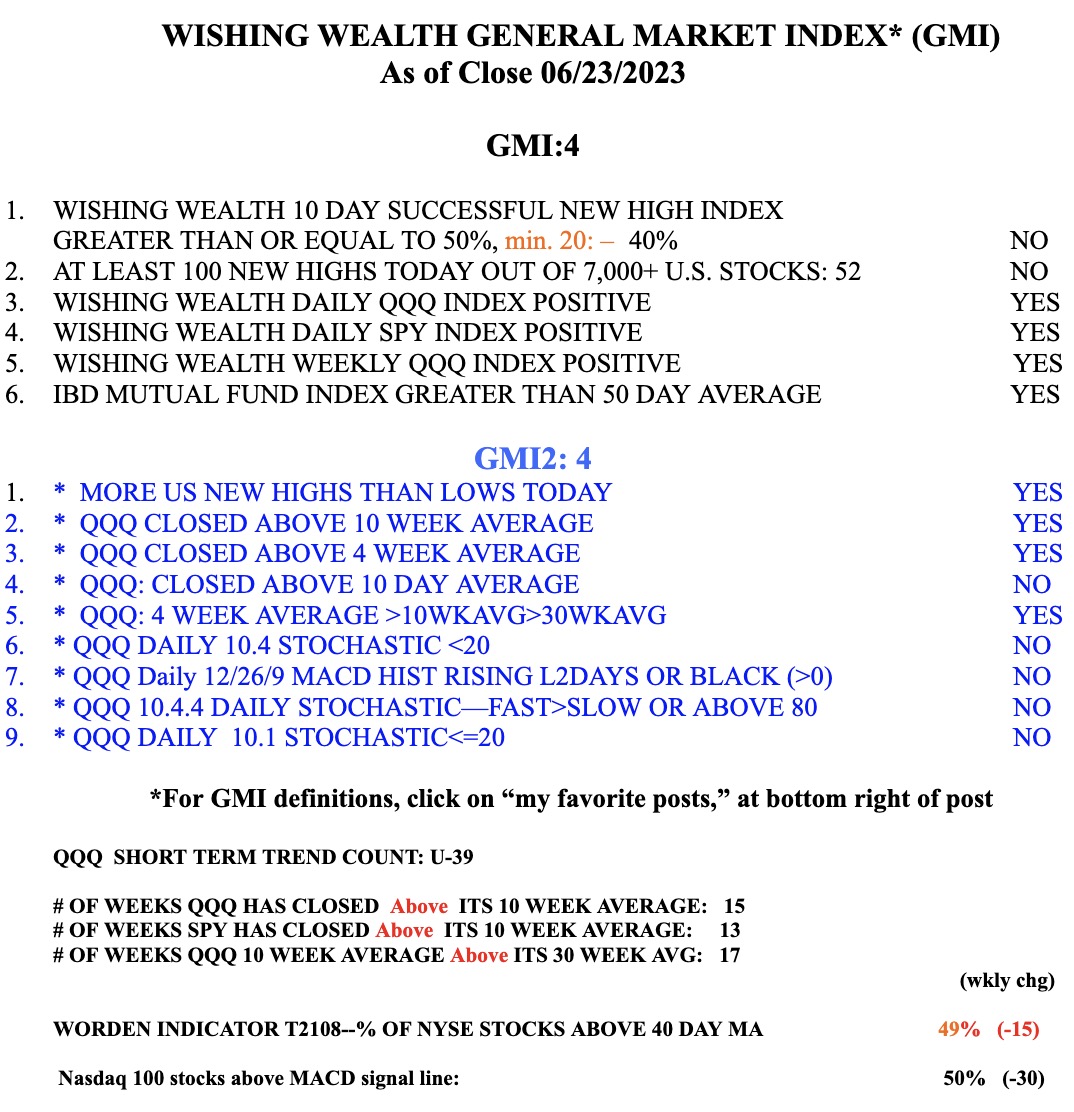

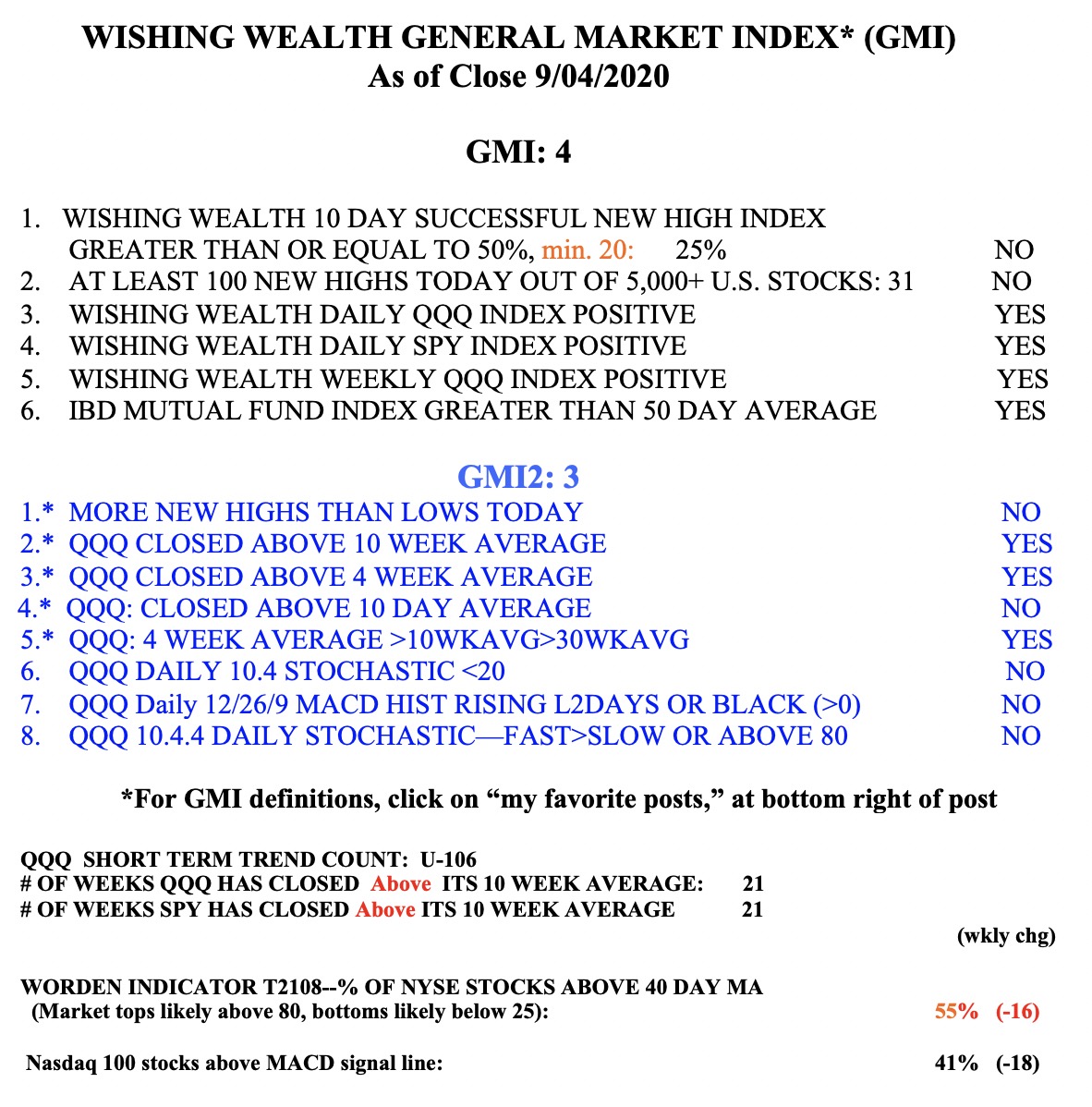

Blog Post: Day 41 of $QQQ short term up-trend, GMI declines to 4

4.9 (767) · $ 26.99 · In stock

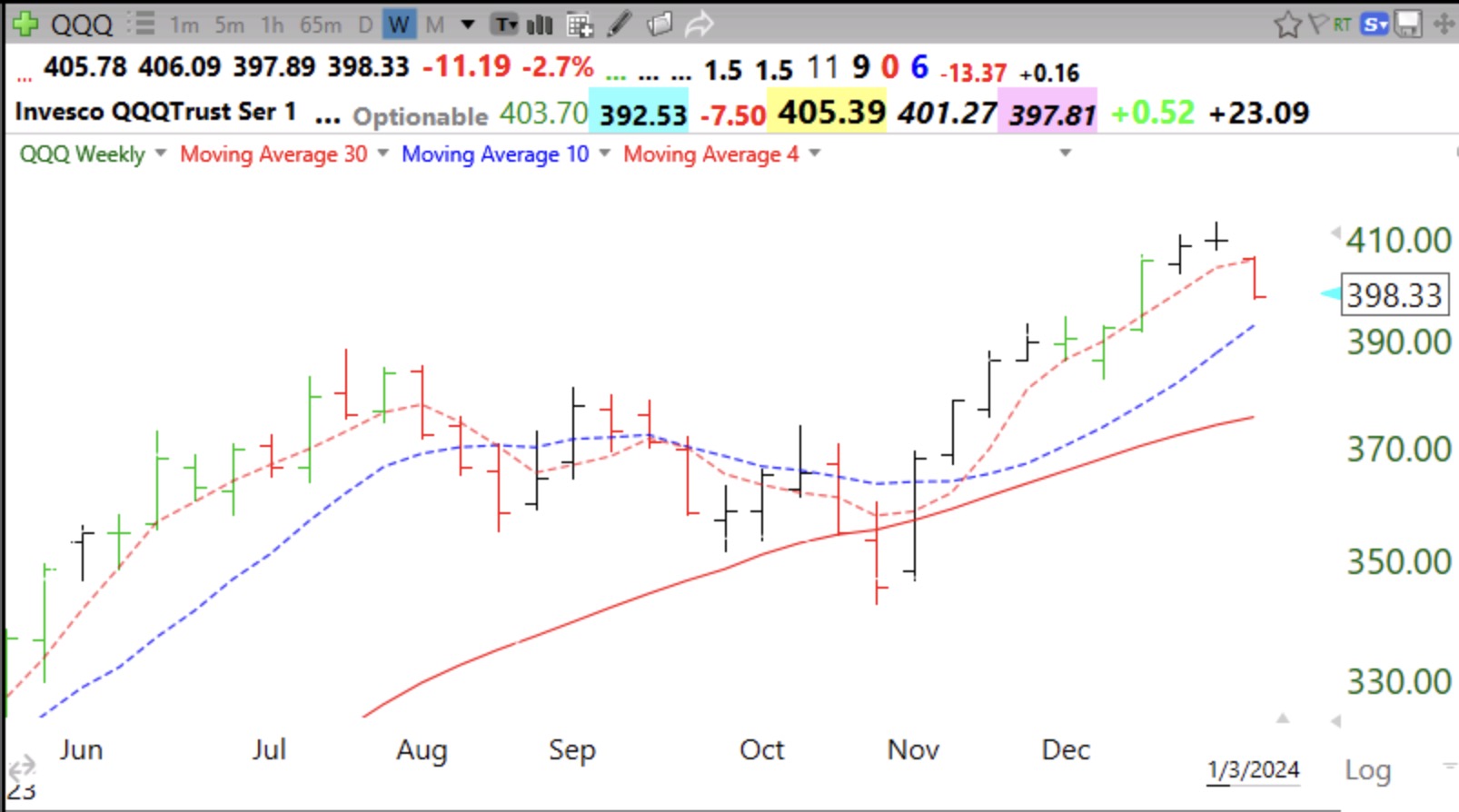

A stong advance is evident when the 4wk>10wk>30 average and the stock continually climbs above the 4 wk average. It is clear from this chart that QQQ is now below the 4 wk average (red dotted line). If it closes the week below, it suggests to me that the recent up-trend is over for now.

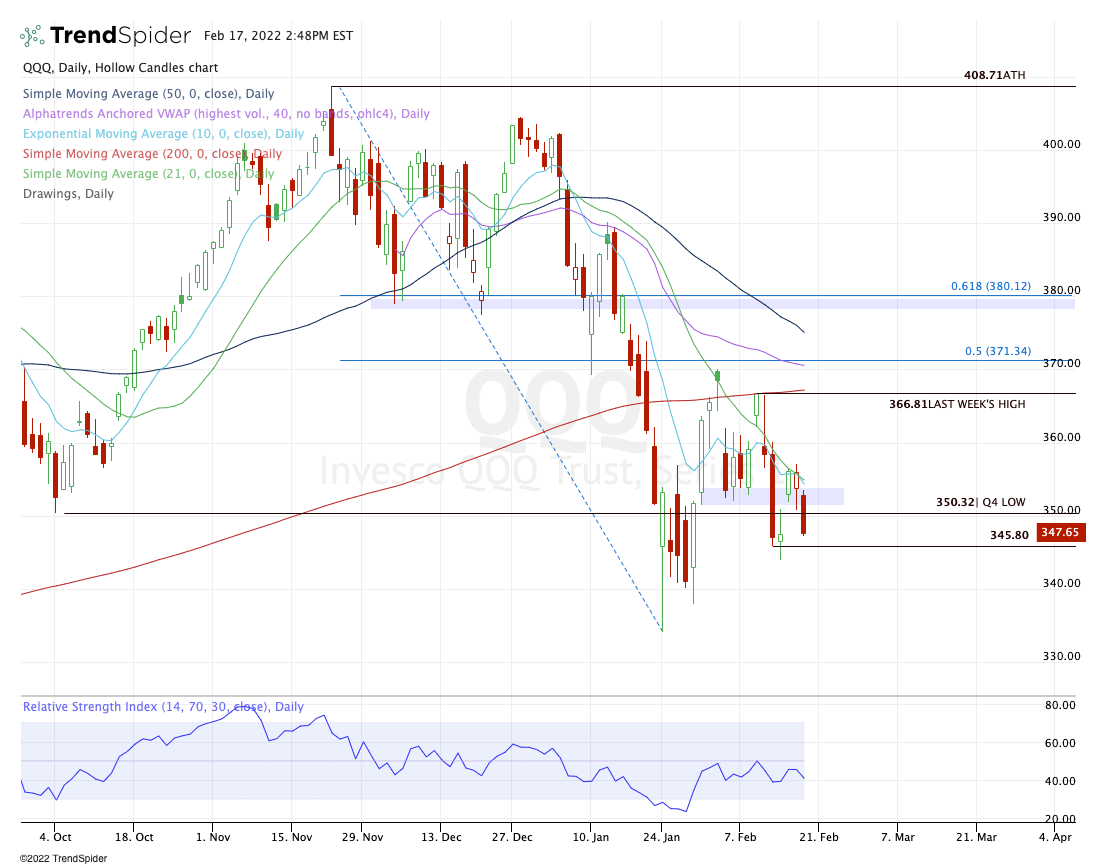

Blog post: Day 31 of $QQQ short term down-trend; Stage 4 down-trend likely, see weekly chart; GMI=0 and Red

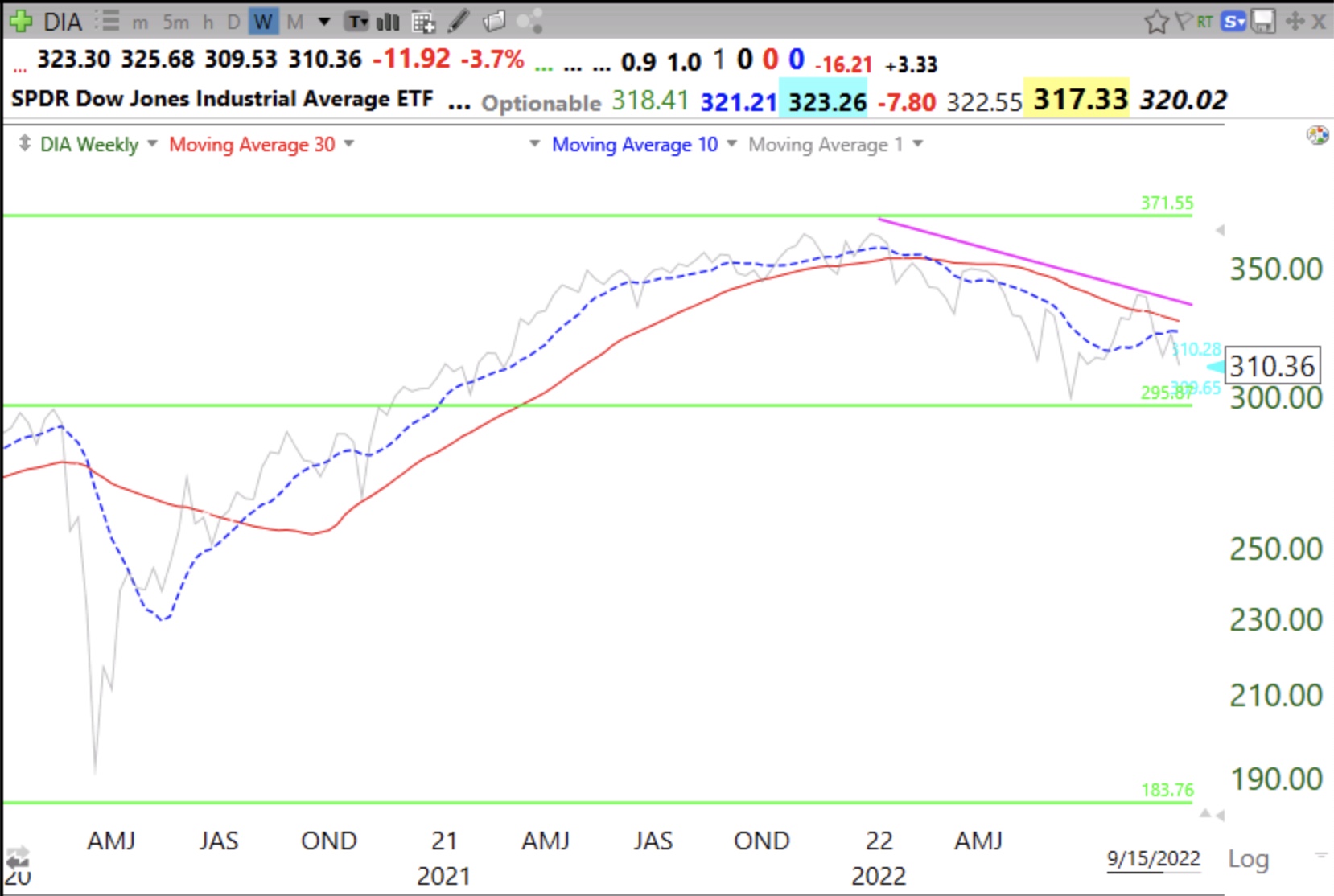

Blog Post: Day 13 of $QQQ short term down-trend; weekly chart of $DIA suggests re-test of last June's lows; how to discern a market bottom–it's easy with a weekly 10:30 chart!

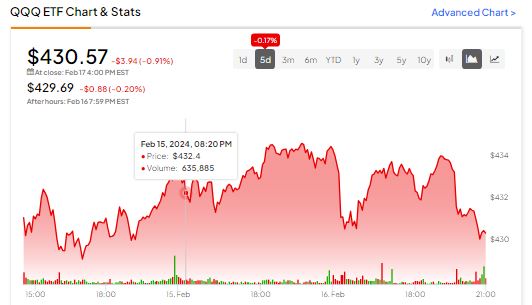

Gap Up Again! QQQ approaches Highs

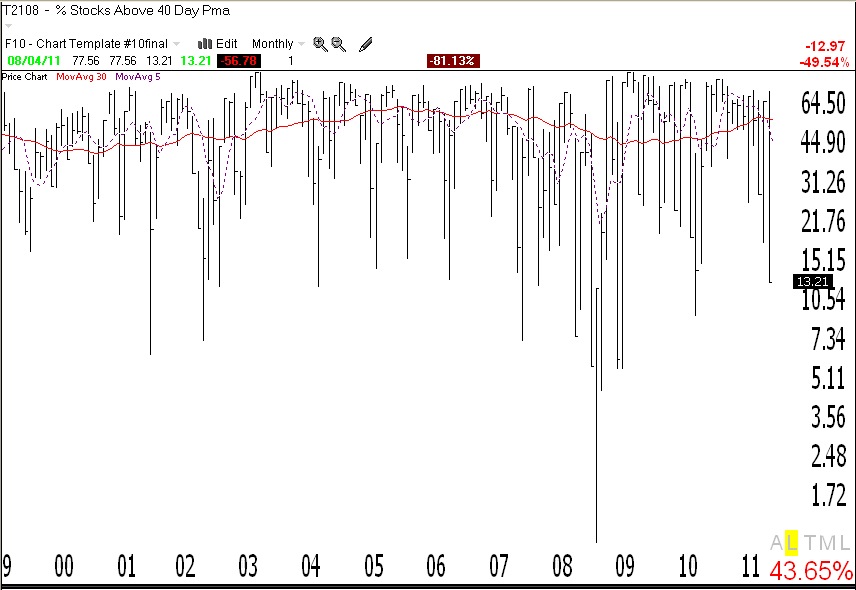

All GMI indicators negative, T2108 at 13%; not enough bears?

Here's a chart of Qullamaggie's # of Positions overlayed with the QQQ's (credits to @inninuM) On top of it is a green/red signal based on data from - Thread from Charlie M @

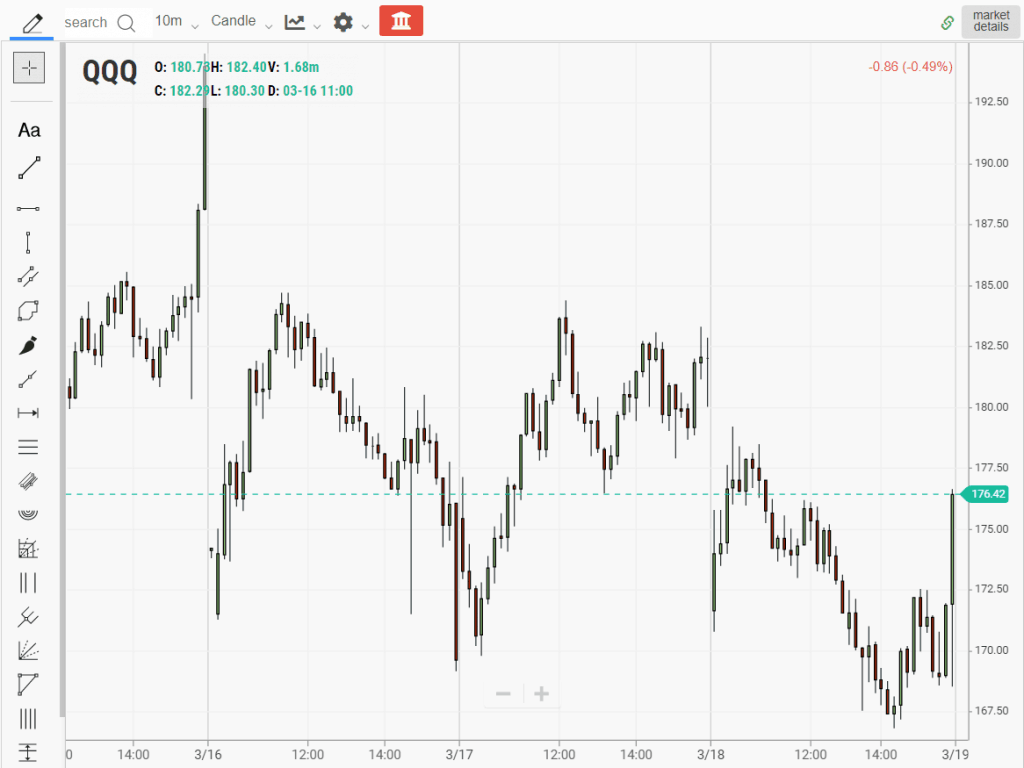

Trade Analysis: QQQ (August 15, 2022)

Blog Post: Day 39 of $QQQ short term up-trend; GMI declines to 4; list of 9 stocks that passed my weekly green bar scan–includes $AAPL, see chart; window dressing upon us?

Moving Averages Month-End Preview: February 2024 - dshort - Advisor Perspectives

New freshmen class and possible online workshop! How I use Bollinger Bands and how this indicator foreshadowed this decline; Just a brief shake-out? Short and long term trends of the market remain

Blog Post: Day 29 of $QQQ short term up-trend; 120 US new highs and 8 lows, 45 at ATH; While many people fear the market this is exactly the time I enter;

:max_bytes(150000):strip_icc()/GettyImages-896777854-ad6104867244456183e949439c5b652e.jpg)