Tie Breaker Rule in International Taxation

4.5 (413) · $ 10.50 · In stock

Plenary 3 INTERNATIONAL TAX CONFERENCE 2019 International Fiscal Association & International Bureau of Fiscal Documentation (IBFD) April 26-27, 2019 The. - ppt download

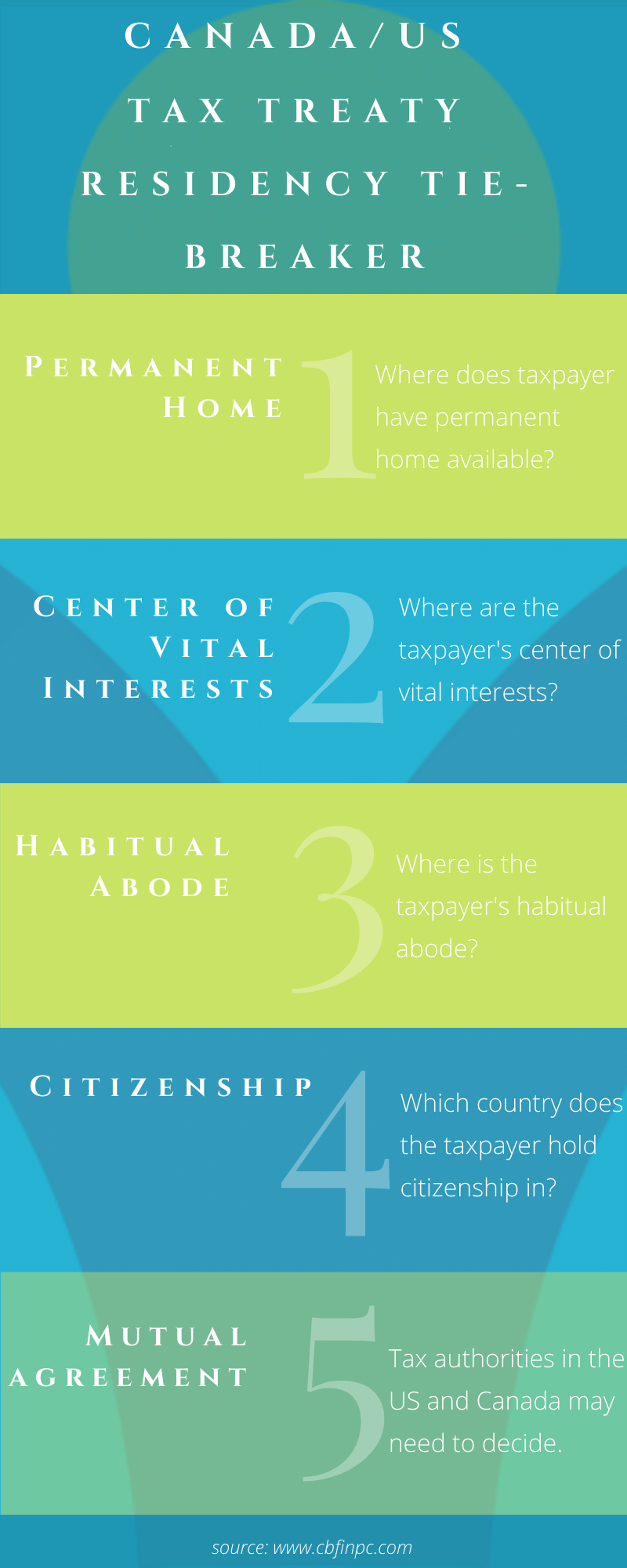

Canada US Tax Treaty Residency Tie-Breaker Rules - US & Canadian Cross-Border Tax Service - Cross-Border Financial Professional Corporation

TIMELY FILING THE FEIE FORM 2555 - Expat Tax Professionals

India-Singapore DTAA Residency Rules: Tie-breaker Questionnaire plays a crucial role but not the only factor in determining residency

PDF) Resolution of Dual Residence Instances in the Case of Companies

WHEN TO CONSIDER A PROTECTIVE 1120-F FILING - Expat Tax Professionals

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

Everything about US-India Tax Treaty and How It Benefits NRI Taxpayers from USA

Plenary 3 INTERNATIONAL TAX CONFERENCE 2019 International Fiscal Association & International Bureau of Fiscal Documentation (IBFD) April 26-27, 2019 The. - ppt download

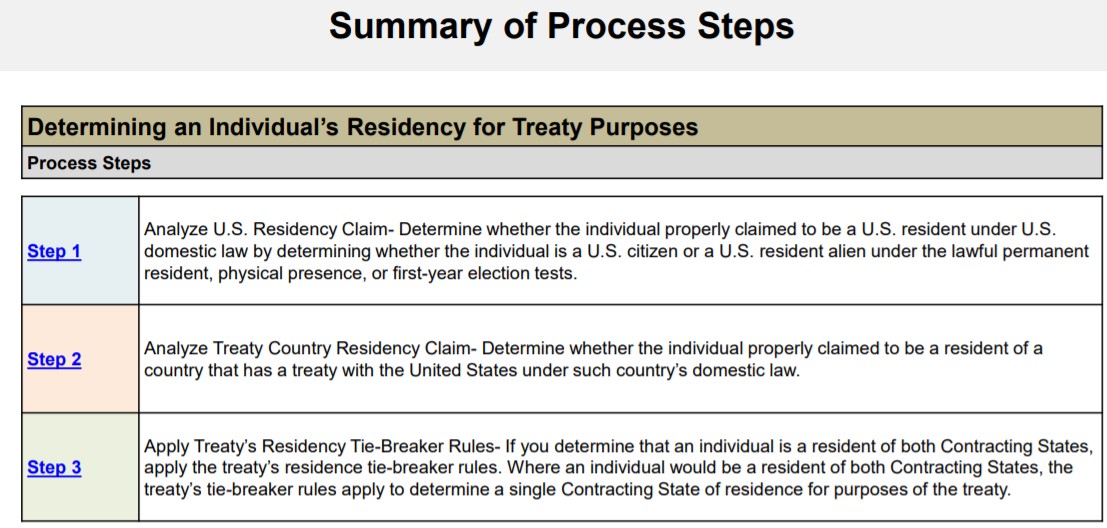

How To Handle Dual Residents: IRS Tiebreakers

Tax residency: Determining Tax Residency: Key Considerations for Expats - FasterCapital

3.21.3 Individual Income Tax Returns

Use of Tie Breaker in Residential Status of NRI's

Article 4 (DTAA) - Concept of Residence - 2023 - Sorting Tax