- Home

- under low

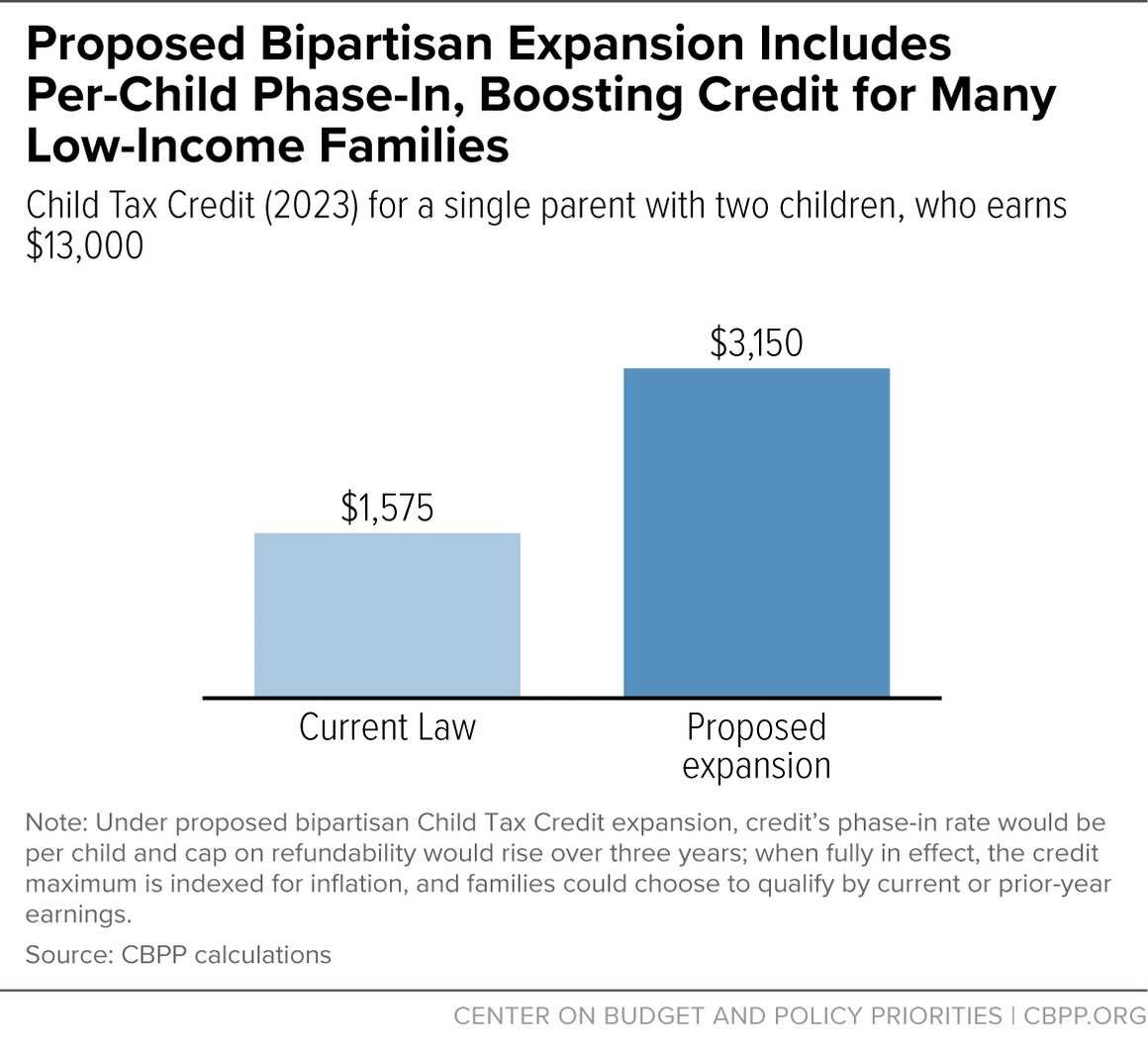

- About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

4.9 (515) · $ 17.00 · In stock

Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025.

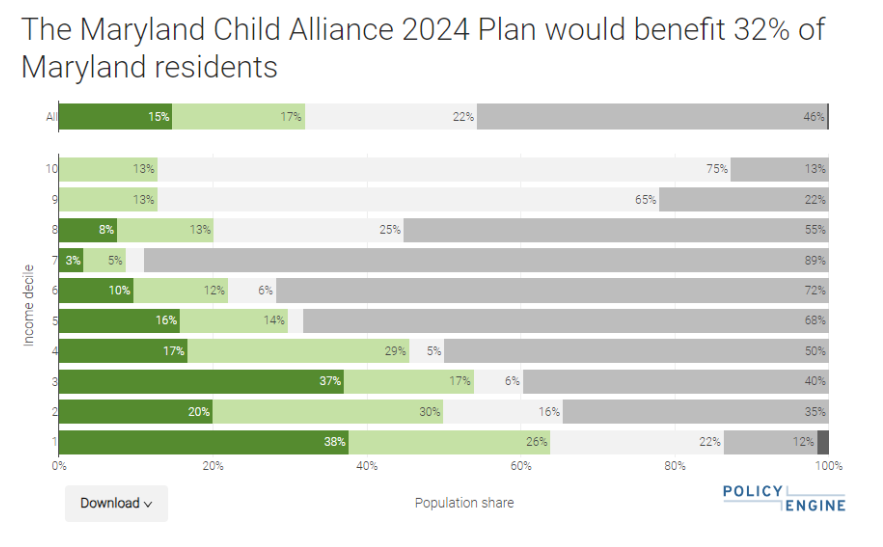

Announcing the Maryland Child Alliance 2024 Legislative Plan: Merging Family Tax Benefits to Include the Most Vulnerable Families, by Maryland Child Alliance

The Impact of Families with No Income on an Expanded Child Tax Credit - Jain Family Institute

Lisa Jansen Thompson posted on LinkedIn

the Early Childhood Partnership of Adams County on LinkedIn

House passes bill to help millions, but Senate GOP doesn't want Biden to 'look good

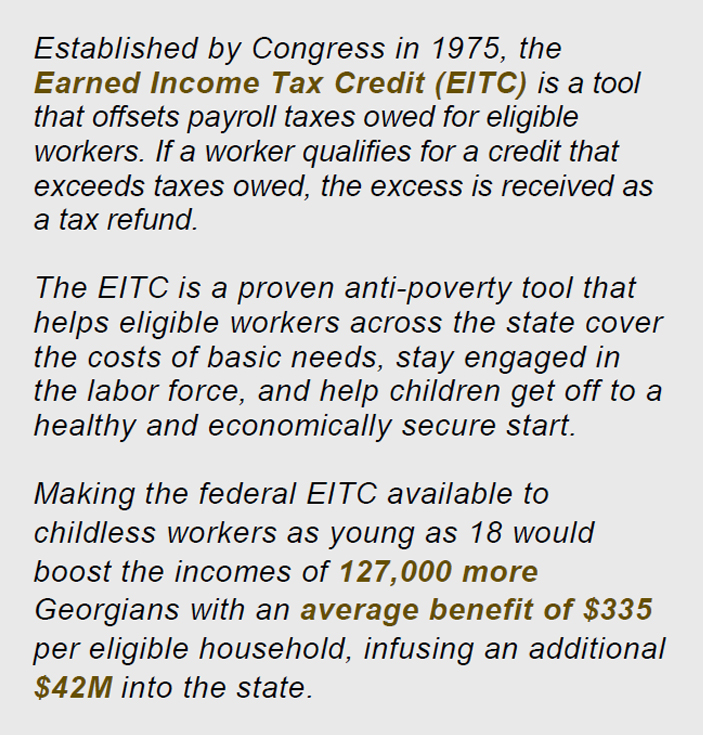

The Earned Income Tax Credit and Young Adult Workers - Georgia Budget and Policy Institute

CBPP (@centeronbudget) • Photos et vidéos Instagram

Top Tax Priority: Expanding the Child Tax Credit in Upcoming

About 16 Million Children In Low-Income Families Would Gain, 60% OFF

Proposed child tax credit expansion would lift half a million children out of poverty by 2025

House passes bill that could give families a nearly $700 tax break

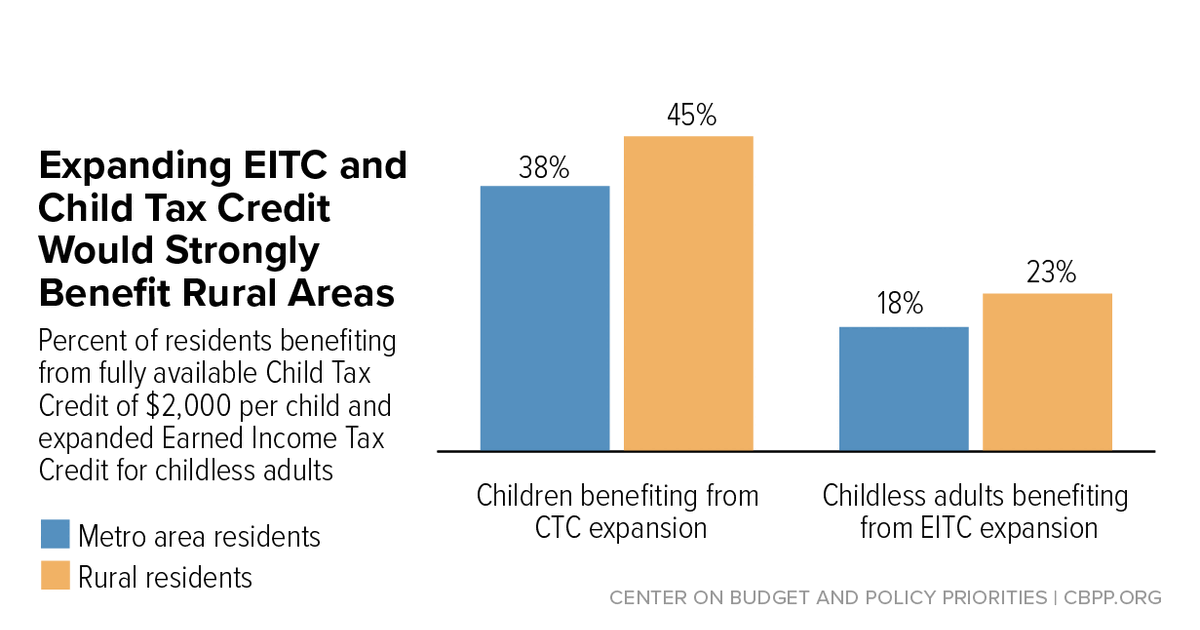

Expanding Child Tax Credit and Earned Income Tax Credit Would

Center for Law and Social Policy on LinkedIn: These words are