Our new investment idea: Hanesbrands Inc (NYSE: HBI)

4.7 (243) · $ 5.50 · In stock

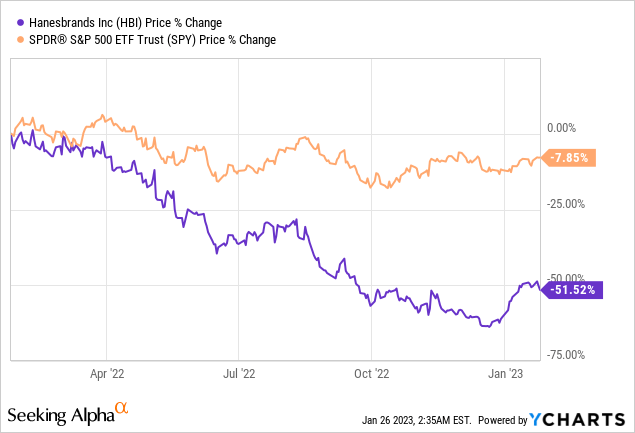

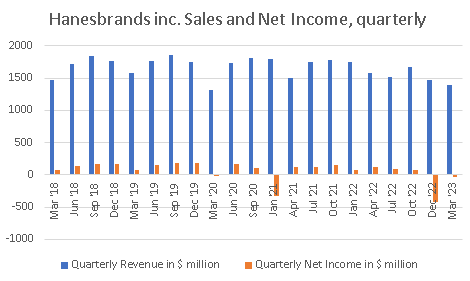

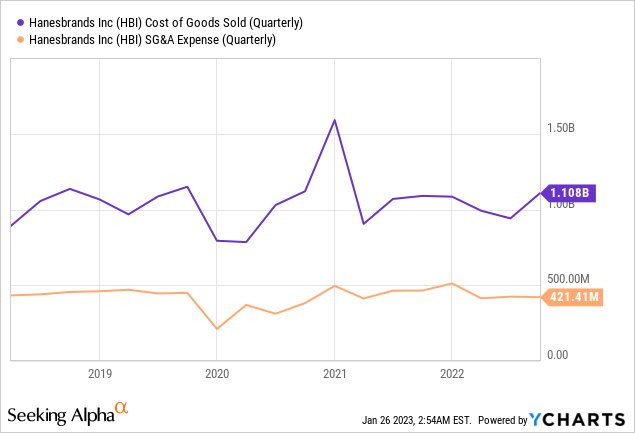

Over the last year, the market has been consistently affected by the consequences of lockdowns, inflation, and financial constraints, which have impacted various industries - particularly the apparel industry. This has resulted in supply chain disruptions and increased production costs, putting pressure on the global apparel market. Because of these challenges, some companies have become potential bargains. In this context, we will explore Hanesbrands Inc. in this write-up.

Hanesbrands Inc. - Subsidiaries of the Registrant. - EX-21.1 - February 08, 2023

HanesBrands Awarded U.S. EPA Energy Star Award for Environmental Stewardship for 14th Consecutive Year

Hanesbrands (HBI) Stock: Undervalued, Could Be Attractive

Hanesbrands: Temporary Headwinds, Long-Term Value (NYSE:HBI)

HanesBrands Announces New $1 Billion Share Repurchase Authorization and Declares Regular Quarterly Cash Dividend

Hanesbrands Q2: Is Reduced Inventory, Market Upheaval Shaping the Future?

Our new investment idea: Hanesbrands Inc (NYSE: HBI)

Hanesbrands (HBI) Stock: Undervalued, Could Be Attractive

Giles Capital (@GilesCapital) / X

Hanesbrands (NYSE:HBI) Stock Price News

Hanesbrands' (HBI) Full Potential Plan Solid, Cost Woes Stay